Traditional recruitment agencies SUCK!

Transactional by nature, poor customer experience, unsuitable candidates… you deserve better.

You need a Talent Partner

Our world leading recruitment brands

Experience the Jarvis Difference.

Join the Talent Revolution.

The traditional recruitment process simply cannot fulfil this vision. We therefore operate as a Talent Partner and deliver outstanding results on a local and global scale within our partnered organisations.

We have achieved this status by adding value within the recruitment process to our clients, candidates and employees.

At Jarvis, we believe in getting right people in the right seats.

We are different by design

The new way to recruit

We get the right people,

in the right seats,

at the right time.

You don’t need to work with overpriced recruitment agencies who are transactional by nature and only focused on getting paid. Leading to unfilled positions, hiring the wrong people, high staff turnover, lower morale, missed project deadlines, and increased workplace stress. Resulting in unhappy customers and costing you money!

Trusted talent partner to the world’s

leading brands.

How our employees see the Jarvis difference

Work With Jarvis

Our offer has disrupted recruitment globally and we want you to join our mission in changing the way the world recruits.

We not only pay three times the best commission in the industry, but we invest in our staff as people. Jarvis offer a clear career path, access to world-leading sales trainers, trips, vacations, generous PTO and the opportunity to be part of an inclusive exciting workplace culture.

We’re on a mission to change the way the world recruits

Our seven values run through the core of our global organization, they define who we are as a group, as individuals, and the way we conduct business.

Respect:

We are committed to delivering a world-class experience for our employees, colleagues, and customers. We achieve this through embracing diversity and acting with the upmost respect for ourselves and others.

Positivity:

We celebrate individual, team & Hire with Jarvis wins by focusing on the “why” and shutting down negativity. Understanding the impact of our journeys in achieving the Jarvis mission.

Commitment:

We are committed to getting the job done through consistently living the Hire With Jarvis values and doing the right thing.

Success:

We go above & beyond to partner with our employees, colleagues, and clients to forge long term successful relationships.

Contact Us

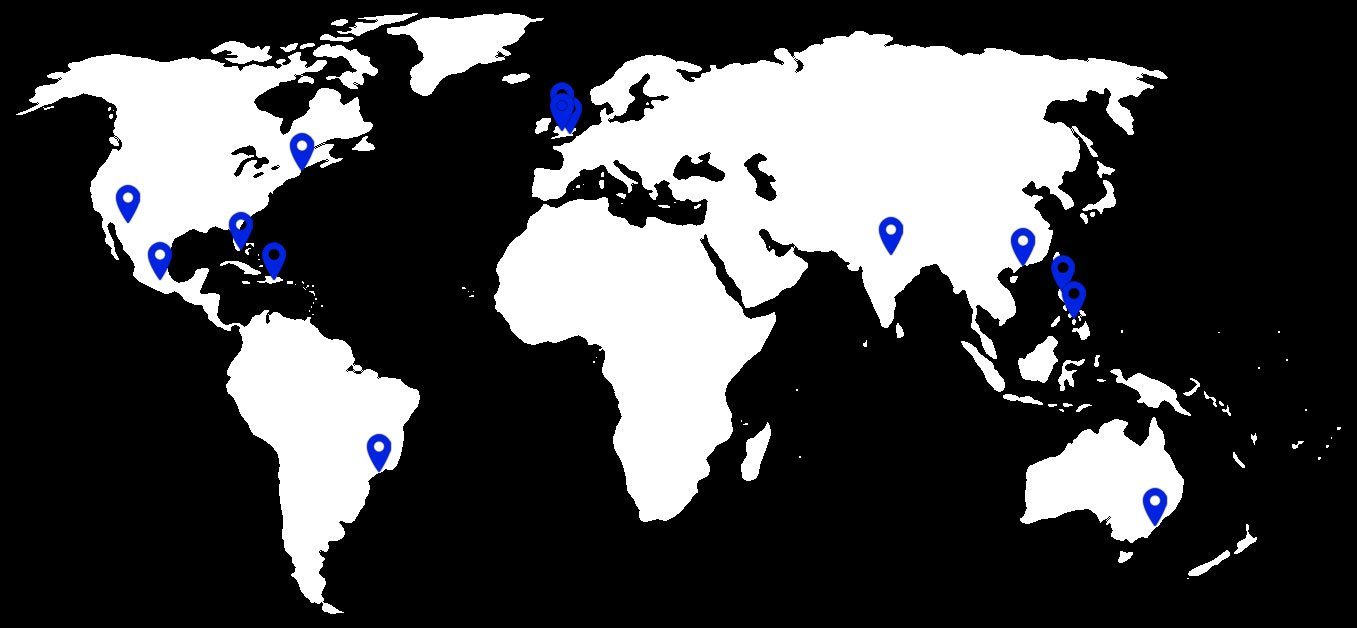

From our global offices across North America, LATAM, EMEA, and APAC we help organizations of all sizes hire the right people, at the right time, into the right seats.

Global HQ

Fort Lauderdale, USA

hello@hirewithjarvis.com

Regional HQ’s

Arizona, USA

New York, USA

Mexico City, MX

Santo Domingo, DR

Sao Paulo, BR

London, UK

Birmingham, UK

Glasgow, UK

Delhi, IN

Hong Kong

Manila, PH

Bacolod, PH

Sydney, AU